Buy real estate with crypto

Discover a new way to acquire real estate, securely, thanks to our expertise.

4.7/5 ★★★★★ | 2000+ clients assisted

Fees

Based on the sale price of the property.

Quick availability

Appointment within 72h. Let’s discuss your project.

Expertise and protection

Collaboration between Lawyers and Notary. Together, we ensure perfect legal and tax compliance of the transaction.

How does it work?

You are a real estate agency

1. Setting up the collaboration

Do you want to offer your clients the option to buy real estate with cryptocurrency to reach more buyers and innovate?

- We set your commission together so you can provide this modern payment solution.

- Reassure the property seller: they will receive the sale price in euros.

- And you too: your commission will also be paid in euros.

2. Project presentation

When a buyer wants to pay with cryptocurrency, you send us the project details:

- The property involved.

- The buyer’s profile and nationality.

3. Due diligence

The buyer provides us with their crypto account number (called a “crypto wallet” or “wallet”). We then analyze the origin of the buyer’s cryptocurrency to confirm that it comes from a legal source. No money transfer takes place at this stage.

- If the funds are illicit: The transaction cannot proceed.

- If the funds are legal: The transaction can move forward.

4. Drafting of the purchase agreement by the notary

We draft the sales agreement, including a clause specifying that the buyer will pay in cryptocurrency, while the seller will receive the funds in euros.

5. Signing of the sale deed and payment in euros

We handle all legal, regulatory, and tax procedures, including overseeing the conversion of cryptocurrency into euros through our regulated Digital Asset Service Provider (DASP), accredited by the French Financial Markets Authority (AMF). We can operate throughout the European Union.

On the day of the sale deed signing at the notary’s office:

- The seller receives the payment in euros.

- The agency receives its commission in euros.

The transaction is successfully completed.

You are an individual

1. Choose your property

Choose the property you want to acquire, whether through a specialized website, real estate agency, or any other channel of your choice.

2. Contact us

Once you’ve selected your property, contact our firm to present your project, indicating:

- The property you wish to acquire.

- Payment terms for the property:

- 100% in cryptocurrencies.

- combination of cryptocurrency + euros.

- crypto and/or euros and financing part of the purchase through a traditional mortgage.

3. Due diligence

Please provide us with the public address of your wallet. We will conduct an analysis of the cryptocurrency’s origin to confirm that it comes from a legal source.

- If the funds are illicit: The transaction cannot proceed.

- If the funds are legal: The transaction can move forward.

4. Drafting of the purchase agreement by the notary

We draft the sales agreement, including a clause specifying that the buyer will pay in cryptocurrency, while the seller will receive the funds in euros.

5. Signing of the authentic deed and payment in euros

We handle all legal, regulatory, and tax procedures, including overseeing the conversion of cryptocurrency into euros through our regulated Digital Asset Service Provider (DASP), accredited by the French Financial Markets Authority (AMF). We can operate throughout the European Union.

On the day of the sale deed signing at the notary’s office:

- The seller receives the payment in euros.

The transaction is successfully completed.

Who are we?

Elias BOURRAN

Attorney at Law – Partner

Ph.D. in Tax Law from Paris Dauphine University

Attorney registered with the Paris Bar Association (France)

Gil LÉONARD

Notary – Partner

Notary office located in Paris (France)

Notary registered with the Paris Chamber of Notaries for over 20 years

Buy real estate with cryptocurrency: an essential opportunity for real estate

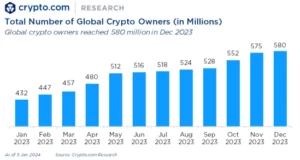

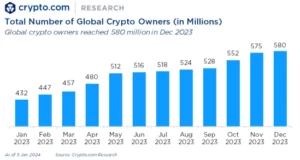

Total number of cryptocurrency holders in 2023 (in millions)

Real estate purchase with cryptocurrency is rapidly gaining popularity and represents a real revolution in the sector. This innovative method attracts a growing number of investors and buyers, drawn by the possibility of conducting real estate transactions using their digital assets directly.

For real estate agencies, offering cryptocurrency transactions allows access to a rapidly expanding market, consisting of many crypto holders eager to acquire property without having to convert their assets into traditional currencies. This innovative positioning can help you expand your clientele and meet a constantly growing demand, both for full cryptocurrency payments and mixed transactions combining crypto and euros.

By offering properties in cryptocurrencies, you attract a dynamic audience, younger and ready to invest more quickly, including foreign buyers who appreciate the opportunity to acquire real estate in France without currency conversion constraints. It’s an opportunity to diversify your offering, to stand out from the competition and to meet the needs of these modern buyers seeking simplicity, speed and flexibility in their real estate transactions.

Case studies: real estate purchase with cryptocurrencies

Example 1

Buying an apartment in Paris with cryptocurrency (USDC)

A buyer wants to purchase an apartment in Paris for €1,500,000 using cryptocurrency, specifically USDC (USD Coin), a stablecoin pegged to the U.S. dollar (1 USDC = 1 USD).

- Exchange rate: 1 USD = 0.90 €

- To cover €1,500,000, the buyer must transfer:

1,666,667 USDC (calculated as €1,500,000 ÷ 0.90 €)

This ensures the seller receives the full amount in euros, while the buyer pays in USDC based on the current exchange rate.

Step 1: Initial contact and project presentation

The real estate agency (or the buyer) contacts us to express their intention to complete the transaction using cryptocurrency. We then collect the following information:

- Details of the property involved.

- Identity of both parties (buyer and seller).

- Crypto account number (known as the “public wallet address” in crypto terminology).

Step 2: Due diligence

In compliance with anti-money laundering regulations (Articles L561-2 to L561-4 of the French Monetary and Financial Code), we are required to verify the identity of the parties (KYC) and conduct an analysis of the origin of the cryptocurrency funds.

Procedure:

- The buyer provides us with the public address of their crypto wallet, which will be used for the payment.

- This address functions like a bank account number, allowing us to trace transactions sent or received by this wallet.

- Example of a public wallet address:

1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

- We conduct a thorough verification to confirm that the funds originate from a legal source.

- If the funds are illicit: The transaction cannot proceed.

- If the funds are legal: The transaction can move forward.

This step takes 2 to 3 days. The buyer can rest assured that no cryptocurrency transfer occurs until the funds’ legal origin is confirmed. They remain in full control of their crypto throughout the process.

Step 3: Drafting the Sales Agreement by the Notary

The notary prepares the sales agreement, incorporating:

- A payment clause stating that the buyer will pay in cryptocurrency, while the seller will receive the funds in euros.

Once the agreement is finalized, it can be signed by both parties.

Step 4: Signing of the sale deed and final payment

We handle all legal, regulatory, and tax procedures, including supervising the conversion of cryptocurrency (1,666,667 USDC) into euros through our regulated Digital Asset Service Provider (DASP), accredited by the French Financial Markets Authority (AMF).

On the day of the sale deed signing at the notary’s office:

- The seller receives the payment in euros.

- The agency receives its commission in euros.

The transaction is successfully completed.

Ready to get started?

Example 2

Buying an apartment in Paris with cryptocurrency (Bitcoin)

An investor wants to purchase an apartment in Paris valued at €5,000,000 using Bitcoin (BTC).

- Bitcoin price at the time of the transaction: €90,000 per BTC

- To cover the €5,000,000 purchase price, the buyer must transfer approximately:

55.56 BTC (€5,000,000 ÷ €90,000 per BTC)

This ensures that the seller receives the full amount in euros, while the buyer pays in Bitcoin based on the current exchange rate.

Step 1: Initial contact and project presentation

The real estate agency (or the buyer) contacts us to express their intention to complete the transaction using cryptocurrency. We then collect the following information:

- Details of the property involved.

- Identity of both parties (buyer and seller).

- The buyer’s public wallet address.

Step 2: Due diligence

In compliance with anti-money laundering (AML) and counter-terrorism financing (CFT) regulations, we conduct identity verification (KYC) and analyze the origin of the cryptocurrency funds.

Procedure:

- The buyer provides the public address of their Bitcoin wallet, which will be used for the payment.

- We conduct an in-depth analysis to confirm that the funds come from a legal source.

- If the funds are illicit: The transaction cannot proceed.

- If the funds are legal: The transaction can move forward.

This verification process takes 2 to 3 days. No funds are transferred until the legal origin of the cryptocurrency is confirmed.

Step 3: Drafting the sales agreement by the Notary

The notary prepares the sales agreement, incorporating:

- A payment clause stating that the buyer will pay in cryptocurrency, while the seller will receive the funds in euros.

Once the agreement is finalized, it can be signed by both parties.

Step 4: Authentic sale deed signing and final payment

We handle all legal, regulatory, and tax procedures, including supervising the conversion of cryptocurrency (55.56 BTC) into euros through our regulated Digital Asset Service Provider (DASP), accredited by the French Financial Markets Authority (AMF).

On the day of the official deed signing at the notary’s office:

- The seller receives the payment in euros.

- The agency receives its commission in euros.

The transaction is successfully completed.

Example 3

Buying a Villa in Nice with mixed payment (Cryptocurrency and Euros)

A buyer wants to purchase a villa in Nice valued at €15,000,000, using a mixed payment method:

- €10,000,000 in the crypto Ethereum (ETH)

- €5,000,000 in euros

Ethereum exchange rate at the time of the transaction: €2,600 per ETH

To cover the crypto portion of €10,000,000, the buyer must transfer approximately: 3,846.15 ETH (€10,000,000 ÷ €2,600 per ETH)

Step 1: Initial contact and project presentation

The real estate agency (or the buyer) contacts us to confirm their intention to complete the transaction with a mix of euros and cryptocurrency. We then collect the following information:

- Details of the property.

- Identity of both parties (buyer and seller).

- The buyer’s public wallet address.

Step 2: Due diligence

In compliance with regulations, we analyze the origin of the 3,846.15 ETH that the buyer intends to use.

Procedure:

- The buyer provides the public address of their crypto wallet.

- We conduct an in-depth analysis to confirm that the funds are legitimate.

- If the funds are illicit: The transaction cannot proceed.

- If the funds are legal: The transaction continues.

This step takes 2 to 3 days, with no crypto transfer occurring until the legal origin of the funds is confirmed.

Step 3: Sales agreement drafting

The notary prepares the sales agreement, incorporating:

- A payment clause stating that the buyer will pay a part of the funds in cryptocurrency, while the seller will receive the total amount in euros.

Once the agreement is finalized, it can be signed by both parties.

Step 4: Signing the sales deed and final payment

We handle all legal, regulatory, and tax procedures, including supervising the conversion of cryptocurrency (3,846.15 ETH) into euros through our regulated Digital Asset Service Provider (DASP), accredited by the French Financial Markets Authority (AMF).

On the day of the official deed signing at the notary’s office:

- The seller receives the full payment in euros.

- The agency receives its commission in euros.

The transaction is successfully completed.

Ready to get started?

Frequently Asked Questions About Real Estate Purchase with Cryptocurrencies

Why buy real estate with cryptocurrencies?

Using cryptocurrency to purchase real estate offers several key advantages:

Faster transactions

- Buyers usually have the full amount available in cryptocurrency, allowing for a much faster process compared to traditional bank financing.

- Unlike mortgage-based purchases, which involve delays due to loan approvals and bank guarantees, crypto payments ensure immediate fund availability, significantly reducing the time to finalize the sale.

Global accessibility

- Cryptocurrencies enable international transactions without currency exchange fees or complex administrative processes.

- Sellers can reach a global market of crypto holders who want to buy real estate directly without converting their assets into fiat currency.

Precautions when buying real estate with cryptocurrencies

Cryptocurrency price volatility

One characteristic of cryptocurrencies is their high volatility. Bitcoin or Ethereum prices can vary significantly within days, which can affect the final property price if the transaction isn’t properly structured.

To eliminate this risk, we set precise conditions in the sales agreement, such as:

- Converting cryptocurrencies to euros at a rate determined at transaction time.

- Using stable cryptocurrencies (stablecoins) like USDC, whose value is pegged to the US dollar, to ensure price stability.

These provisions, written into the sales agreement, ensure a clear transaction without surprises for both parties.

Due diligence

It is crucial to carefully consider the regulations surrounding the use of cryptocurrency in high-value transactions.

This includes:

- Identity verification (KYC) of all parties involved.

- Analysis of the funds’ origin to ensure they come from a legal source.

We ensure that every step of the transaction complies with these legal and regulatory requirements, guaranteeing a secure and compliant process for all parties.

Ensuring security in crypto transactions

Cryptocurrency transactions are irreversible, making strict oversight essential to prevent fraud or errors. To ensure security at every step, we work exclusively with a regulated cryptocurrency exchange platform that holds a DASP (Digital Asset Service Provider) license, approved by the French Financial Markets Authority (AMF).

This DASP accreditation guarantees compliance with the highest standards in security, anti-money laundering (AML), and counter-terrorism financing (CFT).

A secure and structured process

The collaboration between lawyer, notary, and DASP ensures that:

- Funds are protected, and their origin is verified.

- The transaction remains fully compliant with legal and regulatory requirements.

- All parties’ interests are safeguarded throughout the process.

This synergy guarantees a smooth, secure, and risk-free transaction.

Which professionals can assist you in a real estate purchase with cryptocurrency?

To ensure a secure and legally compliant real estate purchase using cryptocurrency, it is essential to work with experienced professionals:

Lawyer

The lawyer plays a key role in securing the transaction, ensuring compliance with anti-money laundering (AML) regulations and legal requirements. Their expertise is also crucial in understanding tax implications and structuring the purchase in an optimized way.

Notary

The notary is essential in any real estate transaction. Their responsibilities include:

- Drafting the sales agreement and official deed.

- Ensuring the legal validity of the transaction.

- Verifying that funds originate from legal sources.

- Ensuring that all parties, including the tax authorities, receive their payments in euros.

Their role is particularly critical in crypto transactions, where legal and financial compliance must be strictly observed.

Digital Asset Service Providers (DASP)

DASP (Digital Asset Service Providers), regulated by the French Financial Markets Authority (AMF), facilitate the conversion of cryptocurrency into euros while ensuring full compliance with financial regulations.

The MiCA (Markets in Crypto-Assets) regulation, adopted by the European Union, imposes strict standards on DASPs and crypto-asset issuers to:

- Strengthen transparency and investor protection.

- Enhance anti-fraud measures in cryptocurrency transactions.

In real estate transactions, this regulation ensures that crypto payments follow a unified legal framework across Europe.

By working with these professionals, a buyer can fully secure their transaction, avoid legal and tax complications, and ensure a smooth property acquisition using cryptocurrency.